Analysis Types

Trading Styles

Active trading is the act of buying and selling securities based on short-term movements to profit from the price movements on a short-term stock chart

The mentality associated with an active trading strategy differs from the long-term's buy-and-hold strategy found among passive or indexed investors.

Active traders believe that short-term movements and capturing the market trend are where the profits are made.

Your trading style could be:

Short Term Trading (Also referred to as Day Trading)

Scalping

- Lasts for a few seconds

- Profit target is around 5-10 pips

- Benefit from a small reversal in market

- Dependence on technical analysis is maximum (100%)

Momentum

- Lasts for a few minutes

- Profit target is around 20 - 50 pips

- Benefit from a major reversal in market/news

- Dependence on TA is 610%, FA 40%

Medium Term Trading

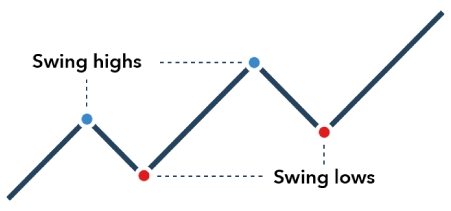

Swing Trading

- Lasts from 1 day to around 3 weeks

- Profit target is around 100 - 150 pips

- Benefit from major moves in the market

- Dependence on technical analysis is minimal (up to 20%)

- Fundamental analysis constitutes 80% of decision making

Long Term Trading

Position Trading

- Lasts more than a month

- Can last for as long as two years

- Profit target is big, over 500 to 600 pips

- Dependence on technical analysis is minimal (up to 20%)